How Real Estate and workplace strategies can help.

Joanne Henderson, Executive Director, CBRE, 2019

Digital technologies have the potential to transform businesses across all industry sectors, but most life sciences companies have not yet made the bolder moves other sectors have in taking advantage of their capabilities.

This is now starting to change with biopharma companies such as Novartis, Pfizer, GSK and Merck & Co all hiring high-profile Chief Digital Offers (CDOs) from more digitally mature industries to spearhead their digital ambitions. This is encouraging given the multitude of benefits digital technologies can bring to this sector: faster drug discovery and development, improved operational efficiency and productivity, more personalised patient experiences and better engagement with key healthcare stakeholders.

Real estate has a central, and often overlooked, role to play in enabling and sustaining these transformations. Some of the real estate occupied by life sciences companies isn’t obviously conducive to attracting digital talent. This means that portfolio and workplace strategies need to actively drive cultural change, with digital talent acquisition and retention seen as an integral part of portfolio and location decisions.

The Digital Talent Challenge

Digital transformations are not easy, even for tech-savvy companies. According to McKinsey1, the pharmaceutical industry success rate of these programmes is only 4-11%, with larger companies more likely to fail. There are many different reasons for this, but accessing the right digital skill set and driving the cultural changes required to transition to new waysof working are two of the biggest challenges.

The opportunity exists to leverage the vast amounts of data available across the healthcare spectrum to drive future value for life sciences companies. However, extracting value from these data assets needs the right combination of people, processes and technology, all operating within an agile and collaborative culture. Ultimately, it is teams, not technology who drive digital success.

Attracting and retaining the talent mix required to make that shift is a key concern for industry executives. According to PwC’s CEO survey2, 60% of life sciences CEOs were very concerned about a digital talent shortage and 57% find it very hard to attract the right calibre of people. McKinsey have reported that demand could be four times supply for agile skills and 50-60% greater than projected supply for big data. For those fortunate enough to secure the top hires, they can be rewarded with double-digit investment savings by accelerating the digital transformation process by up to 20-30%.3

Biopharma and life sciences companies are not just searching the same talent pool as other industry sectors for general digital talent, but are now also facing competition from technology companies for specialist sector talent, such as computational biologists and bioinformaticians.

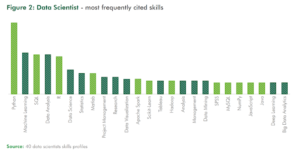

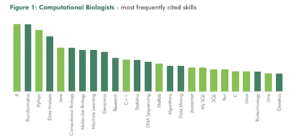

Genomics-based research has created increased demand for these skill sets across life sciences, but technology companies such as Google (Verily life sciences), IBM Watson, even Netflix and Amazon are seeking them out too. Figure 1 shows why – the core skills of a computational biologist/ bioinformatician are actually very similar to broader data scientists,

with programming languages at the forefront, but their scientific knowledge is also extremely desirable for the tech companies focused on healthcare. The career choices available to them now therefore extend way beyond their traditional life sciences paths.

Acquiring and retaining digital talent – the importance of location and workplace experience

The question, therefore, is how can life sciences companies use their real estate as a strategic tool to help them succeed in securing digital talent in an increasingly competitive environment? Many established biopharma companies start disadvantaged because they are still largely situated in out of town campuses, while the highest concentrations of digital talent is generally found in cities.

Millennials make up the majority of the available digital talent pool and around 50% of the global workforce. Although pay is still a major incentive to attract them, 79% consider workplace quality as a key consideration in selecting a new employer and 69% say they’d trade other benefits for the right workplace experience.

It’s therefore no surprise that life sciences companies are now starting to approach programmes designed to create a ‘workplace of the future’ that provides a consistent brand experience across their organisations, regardless of employee function or location. But is this happening quickly enough? PwC’s study suggests biopharma and life sciences executives are actually doing less than the global average to address the digital talent challenge. From a real estate perspective, less than half reported that they are modernising their workplace environment (39%) and only 6% are relocating their operations to be closer to available talent pools.

Innovation clusters providing access to the right technology platforms, collaboration zones and amenities are likely to appeal to the digital natives, but the concept of acquiring permanent fixed physical locations in key cities as a means of accessing them may not necessarily be the whole answer. CBRE’s Portfolio 2040 report predicted a future digitised workforce that will comprise of 50% contingent workers, so both virtual and physical spaces will need to be leveraged to respond to these changing dynamics.

What real estate and workplace strategies can be adopted to attract and retain digital talent?

Some life sciences companies, particularly large biopharma, are now starting to deploy strategies to address the challenge. Multiple initiatives together are likely to be most fruitful given the importance of deploying digital business models for future growth and the scale of the talent shortage:

1. Understand your emerging and future talent requirements and where these skills are located

Developing capabilities for leaders and existing employees is essential for the longer-term success of digital transformation. For instance, Novartis in their ambition to become a medical and data science company have already started investing to ensure leaders and employees are ‘curious’ and ‘comfortable with digital and data’. This includes digital immersion programmes to embed the new ways of working at the most senior level.

However, new digital practitioners will also be required as efforts ramp up, so understanding the profiles that bridge the gap between existing capabilities and a future operating model is key. Some will be sector and geography specific, some more generalist. When that is clear, utilising labour and location analytics to identify the talent hot spots will give an evidence base to inform recruitment strategy and location-based decision making. HR and Real Estate teams will need to work closely to build their digital talent strategy into broader future plans.

However, identifying the talent only informs you of where they are – attracting and retaining them is far more challenging. As a result, an increasing number of organisations are weaving workplace quality and the opportunity for flexible working into their employee value propositions. According to LinkedIn7, there has been a 78% increase in the number of job adverts providing flexible working options since 2016. The healthcare sector is at the bottom of the pile with only 43% of professionals in healthcare companies reporting that they allow workers to work remotely versus 72% in the software and technology sector.

There is a balance to be struck here. Research by Gartner8 indicates there is a negative impact on employee engagement for those employees who work from home regularly for more than two days a week and an equally negative impact for those employees who have no opportunity to work from home. Providing choice to employees on working preferences therefore is key and with the breadth of options available around flex offices and co-working expanding, it is possible to try different approaches.

Back in the office, it is generally acknowledged that our workplace can have a meaningful influence on our performance at work. However, measuring this and convincing senior stakeholders has been based more on faith than science and investments in workplace transformation are still more often weighted more towards real estate reduction than workplace quality. This is starting to change. Life sciences companies, among others, are becoming increasingly conscious of employee health (physical and mental) and with advancements in technology, more research is emerging (CBRE 2016 ‘Healthy Office’ and CBRE 2018 ‘CBRE Lab’) that seeks to prove the link between the quality of work and that of the working environment.

2. Create a workplace that aligns with an agile culture

Digital transformations will struggle to reach their full potential without an agile culture being adopted across the organisation. This is forcing organisations to think differently, building agile into the way they work to emulate the speed and dynamism of smaller, more nimble players.

Roche is reportedly pursuing an agile transformation, starting with leaders and encouraging them to ‘confront patterns of thought that while successful in the past, may now limit their effectiveness’ and introducing them to the practices of agile organizations and how to engage others in the journey, forming cross-functional teams to redesign structures, process and business models.8

Agility can also be hindered by departmental silos, PA’s Agile Organisation report outlines the emergence of new organisational structures with supporting environments. Forward thinking organisations are designing more fluid workplaces, balancing space for open collaboration and private focus, allowing people to personalise their workday. Inclusion of project space makes it easier to connect multi-disciplinary teams quickly and efficiently for a short, intensive meeting or for the duration of a sprint.

The provision of new services and tools also helps to remove the roadblocks to connection and help to make work easier for everyone.9 The challenge for established organisations is overturning years of ingrained traditional working patterns. Losing offices, long-held as the pinnacle of corporate achievement, and working in open spaces is only part of the problem. The real challenge lies in incentivising people to change how they work and how they engage broadly across their organisation.

3. Acquire capabilities and talent through M&A and partnerships

The pharma industry has form in acquiring small innovative biotech companies. However, digital M&A activity has been slower than anticipated to take off, with the industry mostly favouring partnerships and JVs over equity investments. GSK however made a bold move through their $300m equity investment in genomics company 23andMe in 2018. The partnership is at the heart of GSK’s future ‘driven by genetics’ R&D strategy, combining the genetics and data science expertise of 23andMe with the scientific and commercialisation capabilities of GSK.

Pfizer, Novartis, Otsuka and Sanofi have all formed strategic alliances with Verily life sciences (Google’s healthcare spin-off) to transform and accelerate the outdated and inefficient clinical trials process. Verily have a breadth and depth of digital talent who have focused on building their data technology platform, tools and advanced analytics. Google and Sanofi have also just announced their ‘Virtual Innovation Lab’ collaboration which is designed to combine their respective strengths to accelerate the healthcare innovation cycle.

Perhaps it is no surprise that these partnerships are favoured over M&A, accessing the data, tools and talent to support digital ambitions without the challenges of integrating culturally different companies. There are more examples of culture clashes between larger, more established organisations and smaller, more nimble companies than successful integration stories, often resulting in the loss of the innovation and talent that the acquisitions were intended to capture.

4. Create your own digital innovation hubs

Some pharma companies are directly addressing the deterrent role that some of their real estate plays in attracting talent. This is being done by selectively introducing new property formats designed to nurture start-ups and fast-growing innovators. For instance J&J (JLabs), Novartis (Biomes) and Leo Pharma Innovation Labs among others have created separate incubator/start-ups to drive scientific and digital innovation. These environments are designed to feel more agile and entrepreneurial and are purposely situated in geographical locations with rich pipelines of both scientific and digital talent.

5. Collaborate with broader groups and raise brand presence in emerging innovation clusters/ knowledge districts

Partnerships with non-traditional players can fill out a company’s skill set – academia and tech start-ups and clusters are emerging that span both science and technology and reflect the increasing convergence of life sciences, healthcare and technology. Having some form of presence in desired geographical hubs with a start-up feel can drive new collaborations and positive brand associations, providing access to new talent pools either directly or indirectly.

Conclusion –The Way Forward

There is no universal solution to address the digital talent shortage and it will continue to be a challenge across all industry sectors. Life sciences companies can be particularly challenged because of their legacy core locations that often misalign with the urban living and working style favoured by millennials and Generation X as well as perceptions that the highly regulated nature of the industry restricts the speed of digital innovation.

Therefore, business leadership, HR and real estate teams need to work together, activating external partnerships and adopting an agile approach to develop integrated solutions. Understanding the needs, workstyles and preferred environments of digital talent is only the start – but it’s absolutely central to getting this right.